Unbalanced

How property tax assessments create winners and losers

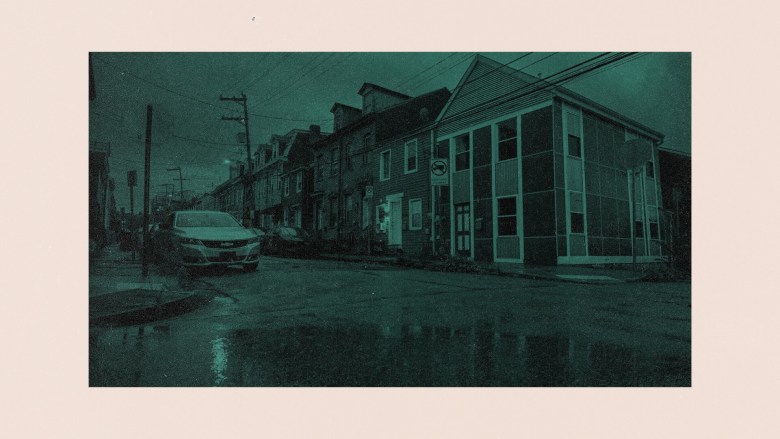

When Maddie Gioffre and Shaquille Charles bought a house in Wilkinsburg in 2020, they’d heard vague mentions that the property taxes could change.

They weren’t prepared, though, for a tax spike that would influence some of the fundamental decisions they face as a young couple. Nor did they expect to become the faces of a challenge to Allegheny County’s increasingly disparate property assessments.

“We were looking for a neighborhood that wasn’t super expensive but was still close to a lot of things in the city, easy commute for him to the med school, walking distance to Frick Park,” said Gioffre, a systems engineer.

They paid $205,000 for a house that needed some renovation. They have come to love Wilkinsburg, said Charles, a fourth-year medical student. But they also feel a little stung. “You buy a new home, and then you’re slapped with the tax,” he said.

School districts throughout the county monitor property sales. Where they find a sale price that is well above the “fair market value” that the county has assigned for tax assessment purposes, they file appeals in hopes of boosting the tax bill. In the case of Gioffre and Charles, an appeal filed last year resulted in a jump in their assigned fair market value, from $87,100 to $179,400. That added a total of around $5,000 to their school, borough and county tax bills.

So much for vacations. “We’ve even pushed back having children,” said Charles. “It’s maybe not because of the taxes only, but that’s a factor that plays into whether or not we can afford a child.”

The two ended up talking with Michael Suley, former manager of the county’s Office of Property Assessments. He told them how the county calculates the tax assessments emerging from appeals, and that he believed there was a flaw in the math. The couple agreed to join a lawsuit seeking to change the math and became the lead plaintiffs, joined by a handful of other couples, businesses and individuals.

A multi-day hearing in the lawsuit is set to start April 27. If the plaintiffs have their way, a judge would order the county to submit new data to a state agency that has a key role in calculating tax bills, potentially pushing thousands of tax bills down.

Meanwhile, Gioffre and Charles pay tax bills that are double those of their neighbors on one side, and triple those of the neighbors on the other. They are quick to note that they don’t want anyone else’s tax bills to soar – but they know other relatively recent homebuyers who have not been subjected to appeals. They would like to see a less arbitrary system.

“I’m all for making schools better. I think Wilkinsburg could use the funds,” said Gioffre. “But I don’t want to be the only one.”

Thousands of appeals in question

Widely differing tax bills, like the ones found on Gioffre’s and Charles’ block, aren’t uncommon in Allegheny County. PublicSource this week described the way that the county’s mostly frozen assessment system and hot home prices have caused a widening gap between the tax bills of more recent homebuyers and those of longtime property owners.

Need a brief primer on property taxes? Click here.

The number of properties on the high-tax side of that gap is likely to rise in coming months.

This year, school districts, municipalities and property owners filed 12,659 assessment appeals (out of more than 580,000 parcels countywide) with the county Property Assessment Appeals and Review Board by its March 31 deadline.

The vast majority (92%) of the properties subject to those appeals are residential. Revenue-hungry school districts filed 89% of this year’s appeals versus 9.5% by property owners seeking assessment reductions, and the tiny remainder by municipalities.

The top school districts in terms of number of appeals filed this year:

- Pittsburgh — 854 appeals

- North Allegheny — 793

- Baldwin-Whitehall — 586

- Shaler Area — 528

- Penn Hills — 524

- Fox Chapel — 510

Districts typically tell the board that the sales prices prove higher market values, and thus warrant higher tax bills. If the districts prevail, the board boosts the assessment – but not all the way to the sale price.

That’s because the county bases property taxes on most properties – those that haven’t been subject to appeals – on values calculated in the so-called “base year” of 2012. State law requires that when counties use a base year, and when appeals generate new assessments, they must be modified using a figure called the Common Level Ratio.

The CLR is calculated by the State Tax Equalization Board [STEB], which compares the values assigned in the base year and the recent sales price data, supplied by the counties. The resulting CLR is then used to ensure that, even as prices rise, new tax assessments are roughly equivalent to the values that existed in the base year.

If the sale prices trend higher, STEB calculates a lower CLR to force new assessments toward base year levels. For instance, the CLR used in Allegheny County for last year’s appeals was 87.5%, meaning a home sold for $100,000 would likely be taxed based on a value of $87,500. Then prices rose, and this year’s CLR thus dropped to 81.1%, meaning that the same sale would likely result in tax bills based on a value of $81,100.

The lawsuit, filed in June by attorney John Silvestri, alleges that since 2016 the county has systematically submitted skewed data to STEB. That “has the effect of artificially inflating the common level ratio” and thus the tax bills on thousands of properties following assessment appeals, he told Common Pleas Judge Alan Hertzberg at a March 29 case status conference.

For instance, in 2020, according to the lawsuit, there were 34,000 property sales in the county. The county submitted records of 5,357 of them to STEB, resulting in the 81.1% CLR.

The lawsuit claims, though, that 1,195 of the sales records sent to STEB may not have reflected market-rate sales between disinterested parties, but were included precisely because the prices were close to those properties’ assessments. That would effectively curb any big downward swing in the CLR. The lawsuit also claims that the other 4,162 sales records sent to STEB weren’t a “representative sample” of the arms-length transactions.

Silvestri claims that if the county had instead used all of the 17,000 property sales reported on the West Penn Multi List — a web portal through which real estate professionals post properties for sale — it would have come up with a CLR of 63.5%. That means the theoretical property sold for $100,000 would be taxed at $63,500, rather than $81,100.

Over thousands of appeals, that higher value adds up to millions of dollars of extra tax revenue per year.

The county — which typically does not comment on litigation — did not address questions emailed by PublicSource on March 30. The county has not yet substantively responded to the accusations in its court filings.

Changing in midstream?

At the court status conference, county Solicitor Andrew Szefi said his side has expressed “our willingness to make those adjustments” in future data submissions to STEB. He added, though, that changing CLRs that have already been calculated and used to inform appeals would “create what some would argue is an inequitable situation” in which different tax bills were calculated according to different ratios.

School districts have echoed that logic, intervening in the case to argue that changes in the CLR could throw their budgets out of whack.

“The school district of Pittsburgh set their [property tax] millage rate in December” based on assumptions on how property assessment appeals would be calculated, said attorney M. Janet Burkardt, who represents the district, after the same hearing.

“They cannot change those millage rates,” she said, adding that if calculations change, “revenues are going to be that percentage lower, which they cannot recover.”

Burkardt said districts have already settled numerous appeal cases filed by commercial property owners, based on a CLR of 81.1%. If the court rules that the correct CLR is lower, then those property owners “will file everything they can with the court to get reconsideration for themselves, and they’ll get it, because they will be due it,” she predicted. “To change midstream violates every principle of law.”

Silvestri argued that a new CLR would not invalidate settlements that are already inked.

“No one’s advocating any dramatic change,” said Barbara Stern, a real estate tax consultant working with the plaintiffs, following the court conference. “We just want the system to work the way it’s supposed to. We want it to be fair to the people who move into Allegheny County.”

‘Trapped, to some extent’

For Gioffre and Charles, a lower common level ratio could shave thousands of dollars off of their total tax bill.

“We’ve also considered moving because of the taxes,” said Gioffre. “We’re not even sure we’d be able to sell” because the taxes are so high.

“We honestly feel trapped, to some extent,” said Charles.

They added that they put their names on the lawsuit not to save money for themselves but to address what they see as a systemic problem that punishes both new homeowners and communities like Wilkinsburg. Inequitable taxes create a “vicious cycle,” which discourages investment in homes, spurs abandonment and forces millage increases, said Charles.

“Which is unfortunate, because there’s so much benefit that could come from people buying properties in Wilkinsburg,” said Gioffre. “There’s a lot of vacant houses. … It would be nice to see more people buy here, but the taxes are so prohibitive.”

Rich Lord is PublicSource’s economic development reporter. He can be reached at rich@publicsource.org. or on Twitter @richelord.

How property taxes work

Property taxes cover the biggest share of the cost of local government and are supposed to be related to the values of taxable land and buildings. In Pennsylvania, counties have the job of estimating the fair market values of taxable properties.

State law allows counties, municipalities and school districts to abate some portion of that value for homeowners, seniors, farmers and a few other categories of owners. Allegheny County, its school districts and some municipalities including Pittsburgh have various abatements for homeowners. The county, for instance, doesn’t count the first $18,000 in a homeowner’s fair market value when calculating the tax due.

The taxing bodies must then multiply the remaining values by their tax rates — referred to as millage — to get the tax bill.

(Fair market value – abatements) x the millage rate / 1,000 = property tax

In 2012, Allegheny County Executive Rich Fitzgerald decided to keep using that year’s property value assessments indefinitely, rather than continue a series of contentious mass reassessments. That effectively froze the assessments of property owners who don’t move or make major changes to their buildings.

Property owners, though, may appeal their own assessments, and school districts and municipalities can challenge the valuations of any property within their borders. Taxing bodies often file appeals when a property sells for a price that’s far higher than its assessed value, arguing that the sale proves the fair market value.

The Property Assessment Appeals and Review Board then decides whether the appeal is valid. It applies a new assessment, often based on the sales price modified by a Common Level Ratio meant to approximate 2012 values.